Definition of NTBs

According to the COMESA-EAC-SADC NTB online reporting mechanism, Non-Tariff Barriers (NTBs) refer to restrictions that result from prohibitions, conditions, or specific market requirements that make importation or exportation of products difficult and/or costly. NTBs also include unjustified and/or improper application of Non-Tariff Measures (NTMs) such as sanitary and phytosanitary (SPS) measures and other technical barriers to Trade (TBT). NTBs arise from different measures taken by governments and authorities in the form of government laws, regulations, policies, conditions, restrictions or specific requirements, and private sector business practices, or prohibitions that protect the domestic industries from foreign competition.

Classification of NTBs

The COMESA-EAC-SADC NTB online reporting mechanism classifies NTBs into eight categories namely:

- Government Participation in Trade and Restrictive Practices Tolerated by Governments

- Customs and Administrative Entry Procedures

- Technical Barriers to Trade

- Sanitary and Phyto-Sanitary Measures

- Specific Limitations

- Charges on Imports

- Other Procedural Problems

- Transport, Clearing and Forwarding

Further, an NTB can be classified as Actionable or Non-Actionable. Actionable NTBs are NTBs that can be removed without having to change legislation or a regulation, e.g., misapplication of custom procedures or an arbitrary classification of goods under incorrect HS codes. Non-Actionable NTBs are NTBs that cannot be removed without changing legislation or a regulation, e.g., if a government introduces a law banning the importation of a stable food crop to protect domestic producers or a new legal requirement for labelling of goods.

The Case of EAC

Since 2004 up to June 2022, EAC had reported 256 NTBs and resolved 234 translating to a resolution rate of 91.4%. The outstanding NTBs were 22. At the end of the 32nd EAC NTB Regional Monitoring Committee meeting held in Kigali Rwanda in June 2022, 10 NTBs were resolved and an additional one reported. To date since 2004, 257 NTBs have been reported in EAC, 244 resolved and 13 are outstanding. This translates to an NTB resolution rate of 94.9% in EAC.

Noting the urgent need to streamline trading among Partner States, TMA through funding from USAID, UKAID and the Netherlands, partnered with EAC in 2017 to offer capacity building on NTBs reporting, monitoring and elimination mechanisms as well as the support to National NTB monitoring committees. Before the partnership, minimal reporting of NTBs was witnessed across the region, leading to longer resolution periods. For example from 2004 to 2015, 114 NTBs had been reported and 27 were yet to be resolved translating to a resolution rate of 76.3%. To date more NTBs are being reported and being resolved within a short period as shown by the increased number of reported NTBs from 114 in 2015 to 257 in June 2022 and a resolution rate improvement from 76.3% in 2015 to 94.9% in June 2022.

Most of the outstanding NTBs are on discriminatory charges, fees and levies by Partner States, non-preferential treatment of goods originating from Partner States, non-recognition of calibration certificates from Partner States and requirement for upfront payment of guaranteed cheques for storage of oil and penalties after expiry of grace period. Among the outstanding 12 NTBs, Tanzania has imposed 6, Uganda 5 and Kenya one while Kenya has reported 5, other EAC Partner States 3, Uganda 1, Tanzania 1, South Sudan 1 and Rwanda 1.

Most of the outstanding NTBs are on discriminatory charges, fees and levies by Partner States, non-preferential treatment of goods originating from Partner States, non-recognition of calibration certificates from Partner States and requirement for upfront payment of guaranteed cheques for storage of oil and penalties after expiry of grace period. Among the outstanding 12 NTBs, Tanzania has imposed 6, Uganda 5 and Kenya one while Kenya has reported 5, other EAC Partner States 3, Uganda 1, Tanzania 1, South Sudan 1 and Rwanda 1.

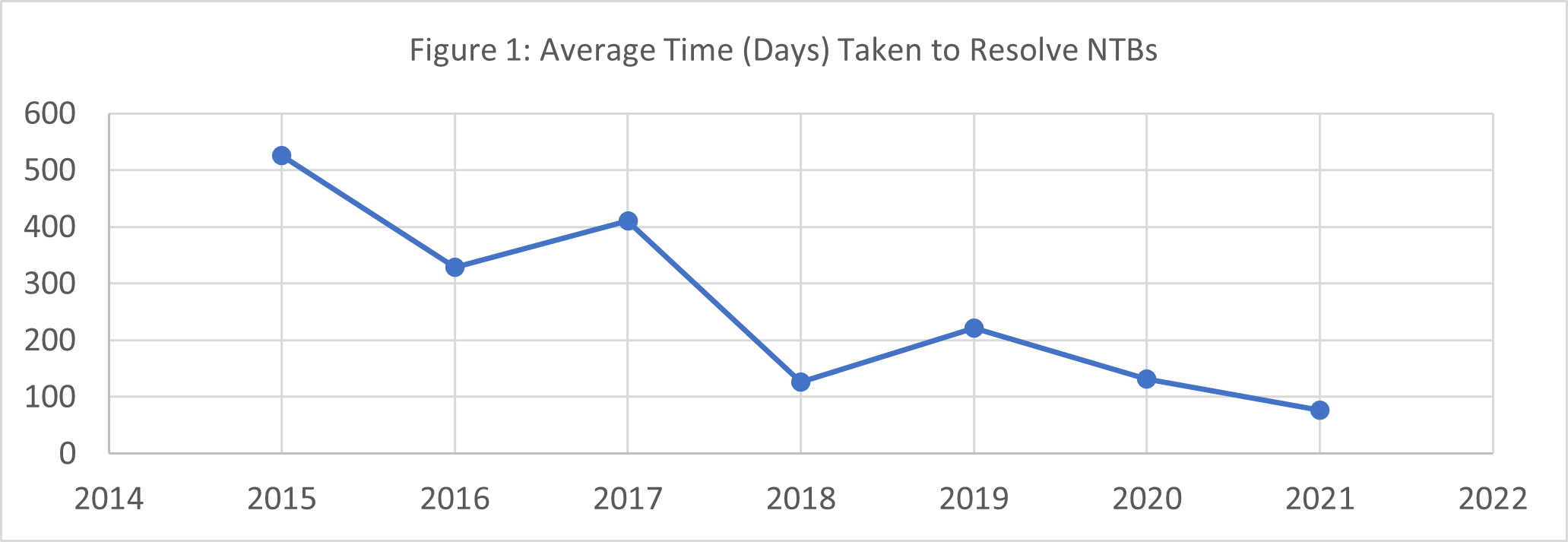

From the EAC Time Bound Programme report, June 2022, in 2015, there were nine (9) reported NTBs, and on average, it took 525.3 days to resolve each of them. Some specific cases (e.g., NTB-000-806 – Tanzania requirement that trucks passing three weigh bridges are required to buy stickers at US$40 per sticker despite the fact that trucks are clearly marked transit in the central corridor) took 1,045 days and it had to be resolved by the Extra Ordinary Sectoral Council on Trade, Industry, Finance and Investment (SCTIFI) meeting. In 2016, there were 14 reported cases of NTBs, and it took an average 328.4 days to resolve. It is noted that in 2017, the average time taken to resolve NTBs was 410.2 days while in 2018, it was 126.6 days – a significant drop in the time taken, attributable to TMA’s support to EAC on NTBs. There was a slight increase in 2019 (to 221.7 days) due to the coronavirus pandemic. However, the downward trend has resumed to 131.3 days in 2020 and 76.6 days in 2021. This trend is presented in figure 1.

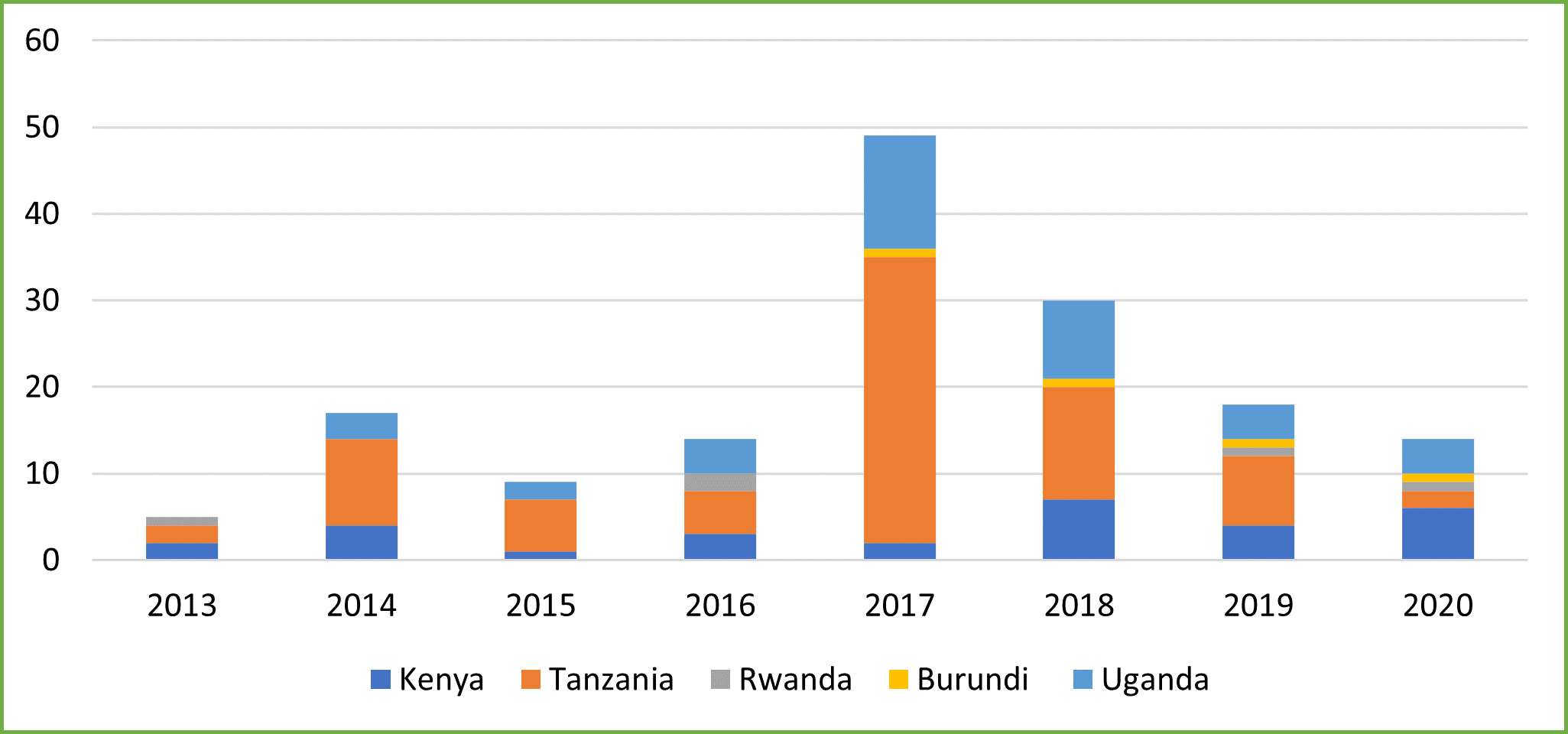

WTO figures show that, since 2000, the annual number of non-tariff trade restrictions has risen from 750 in 2000 to 1,480 in 2017, a 97% increase. At the same time, within the EAC, we see an increase in reported NTBs in 2017 by Tanzania attributable to TMA’s support to National NTB monitoring committees.

WTO figures show that, since 2000, the annual number of non-tariff trade restrictions has risen from 750 in 2000 to 1,480 in 2017, a 97% increase. At the same time, within the EAC, we see an increase in reported NTBs in 2017 by Tanzania attributable to TMA’s support to National NTB monitoring committees.

Since 2017, when TMA started supporting EAC on NTBs, there has been a general decrease in reported NTBs in the EAC.

Since 2017, when TMA started supporting EAC on NTBs, there has been a general decrease in reported NTBs in the EAC.

Impact of NTBs in EAC

To show the impacts of NTBs on trade and general livelihoods, we shall take a few examples from the EAC Time Bound Programme, a system that shows the reported NTBs, and their status – whether resolved, pending or in progress.

Laundry Soap Bars from Kenya to Uganda

Laundry Soap Bars from Kenya to Uganda

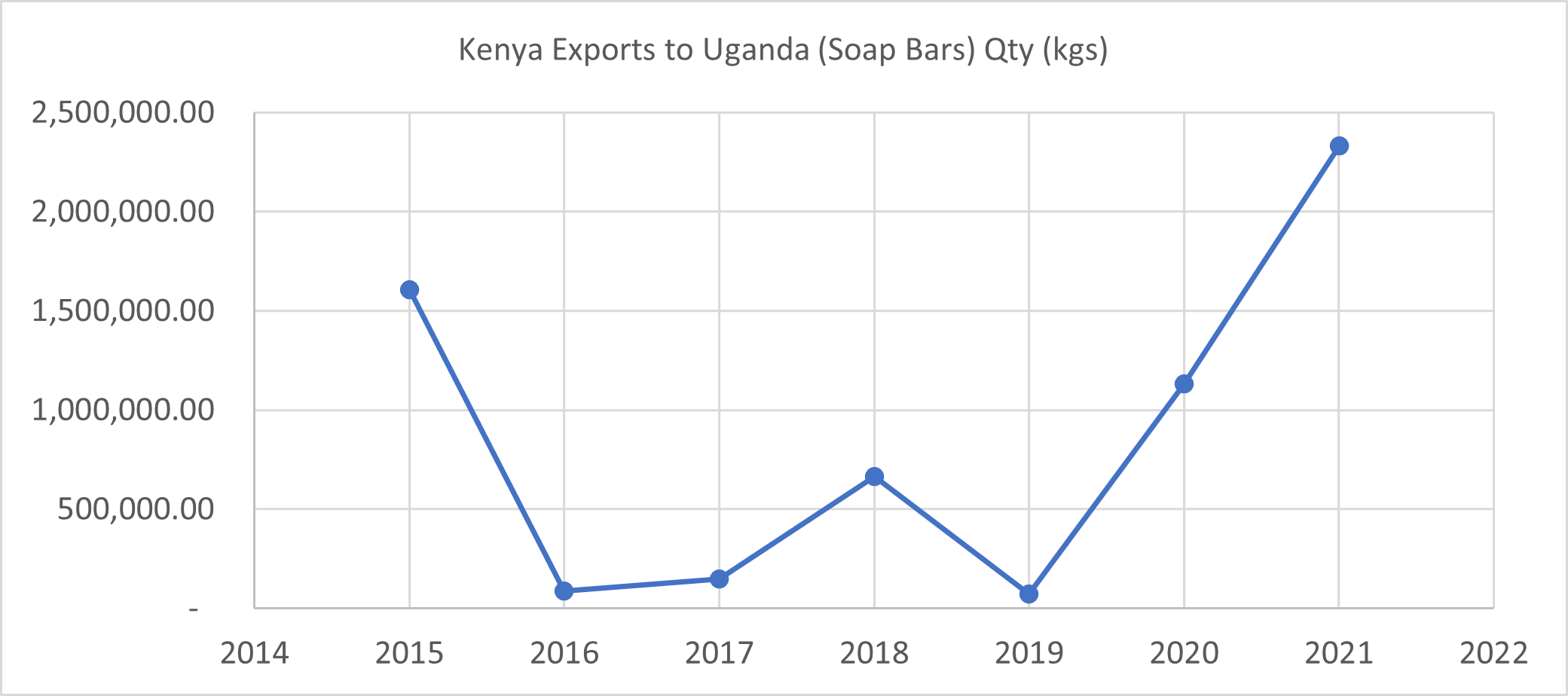

On 12th October 2015, under NTB Complaint No. NTB-000-681, it was reported (by Kenya) that the Republic of Uganda had discriminatively imposed a 10% duty on Kenyan manufactured laundry bar soaps. It took 262 days to resolve this matter, on 30th June 2016.

Using UN Comrade data, this affected trade between the two countries as follows:

Table 1: Kenya Exports to Uganda (Laundry Soap Bars) 2015 – 2021

| Kenya Exports to Uganda (Soap Bars) | |||

| Year | Qty (kgs) | Trade Value (US$) | Unit Cost |

| 2015 | 1,604,465 | 941,273.00 | 0.59 |

| 2016 | 86,556 | 112,444.00 | 1.30 |

| 2017 | 147,955 | 133,256.00 | 0.90 |

| 2018 | 665,139 | 938,408.00 | 1.41 |

| 2019 | 71,787 | 67,047.00 | 0.93 |

| 2020 | 1,130,584 | 994,877.00 | 0.88 |

| 2021 | 2,333,141 | 1,569,381.00 | 0.67 |

Before the NTB, Kenya exported over 1.6 million kgs of soap to Uganda, worth about $941,000; but when the NTB was introduced, trade reduced to just about 86,000 kg worth just over $100,000. This shows a 90% drop in trade, that cost businesses over $800,000 in lost revenues. After resolution of the NTB in 2016, the quantity increased gradually to 147,955 kgs in 2017 and 2.3 million kgs in 2021. This shows that the resolution of the NTB has increased the exports of bar soaps from Kenya to Uganda by 2.2 million Kgs in 2021 (2,333,141 – 86,556) which translates to USD 1.5 million.

This can also be illustrated in a graph as follows:

Figure 1: Kenya Exports to Uganda (Laundry Soap Bars) 2015 – 2021

Rice from Tanzania to Rwanda

Rice from Tanzania to Rwanda

On 4th May 2016, under NTB Complaint No. NTB-000-707, it was reported that Rwanda did not accord preferential treatment for rice originating from Tanzania as per the requirement of the EAC Rules of origin. This matter took 299 days to be resolved on 6th May 2017.

The impact is shown as follows:

Table 2: Rice Exports from Tanzania to Rwanda (2017 – 2020)

| Rice Exports from Tanzania to Rwanda (2017 – 2020) | ||

| Year | Net weight (kg) | Trade Value (US$) |

| 2017 | 35,000.00 | 28,376.00 |

| 2018 | 3,179,286.00 | 888,041.00 |

| 2019 | 12,682,550.00 | 9,894,021.00 |

| 2020 | 59,473,040.00 | 35,268,031.00 |

When the NTB was imposed rice exports from Tanzania reduced drastically and in 2017 the exports were only 35,000kgs. After resolution of the NTB, the rice exports from Tanzania to Rwanda in 2018 increased to 3.2 million Kgs and has been increasing. In 2020 it peaked to 59 million Kgs at a value over $35 million.

- Garments Exports from Tanzania to Rwanda

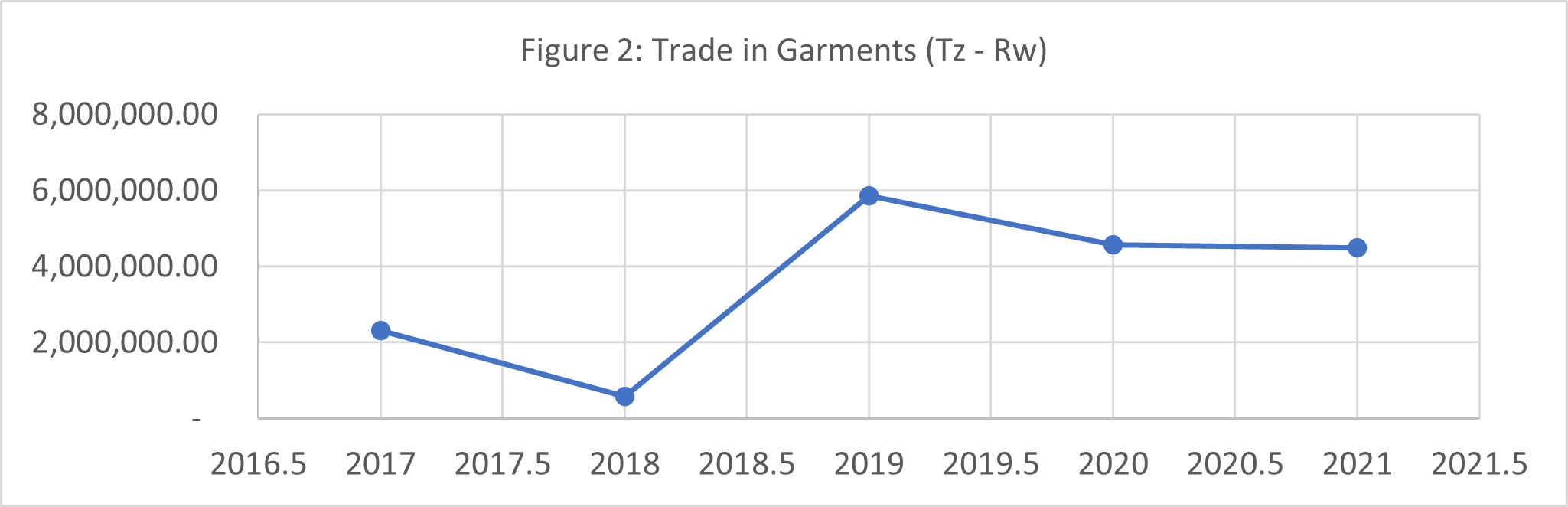

On 28th August 2019, under NTB Complaint No. NTB-000-910, it was reported that the Rwanda Revenue Authority had denied preferential treatment on silk coat products from Tanzania. This matter took 322 days to be resolved on 1st September 2020.

Table 3: Trade in Garments (Tanzania – Rwanda)

| Trade in Garments (Tz – Rw) | ||

| Year | Trade Value (US$) | |

| 2017 | 2,310,979.00 | |

| 2018 | 584,497.00 | |

| 2019 | 5,853,509.00 | |

| 2020 | 4,562,140.00 | |

| 2021 | 4,485,966.00 | |

It is worth noting that trade reduced by over $1 million between 2019 and 2022, and this can be explained partly because of the introduction of the NTB.

Conclusion

Conclusion

From the brief analysis, TMA has contributed to the reduction of NTBs through its support to EAC to include: capacity building efforts, support to National Monitoring and Regional Monitoring Committees, development, and enhancement of NTB reporting, monitoring, and elimination mechanisms as well as review of NTBs Act. So farthe following has been achieved:

- The time taken to resolve NTBs has reduced from an average of 523.6 days in 2015 to 76.6 days in 2021

- The NTBs resolution rate has improved from 76.3% in 2015 to 94.9% in June 2022.

- Imposed NTBs led to a significant decrease in exports and revenue for the affected products. For example; An NTB imposed by Uganda on Kenyan laundry soap bars in 2015 led to a decline of its exports from 1.6 million kgs worth about $941,000 to just about 86,000 kg worth just over $100,000. This shows a 90% drop in trade, that cost businesses over $800,000 in lost revenues.

Similarly, an NTB imposed on Tanzanian rice by Rwanda reduced rice exports from Tanzania to Rwanda drastically and in 2017 the exports were only 35,000kgs.

Another NTB imposed by Rwanda on Tanzania originating garments in August 2019 led to trade reduction by over $1 million between 2019 and 2020.

- Timely resolution of NTBs led to a significant increase in exports and consequently an increase in intra-EAC trade. For example; Resolution of the NTB between Kenya and Uganda on laundry soap bars in 2016, increased the quantity gradually to 147,955 kgs in 2017 and 2.3 million kgs in 2021. This shows that the resolution of the NTB increased the exports of bar soaps from Kenya to Uganda by 2.2 million Kgs in 2021(2,333,141-86,556) which translates to USD 1.5 million. After resolution of the NTB on non-preferential treatment for rice originating from Tanzania by Rwanda, rice exports from Tanzania to Rwanda increased in 2018 by 3.2 million Kgs and it has been increasing since then reaching 59 million Kgs in 2020 at a value of over $35 million.

- Resolution of NTBs has led to improvement of the welfare of EAC citizens through directly increasing trade and revenues which led to employment creation and indirectly increase in household incomes for the traders and consequently improved livelihoods.

TMA’s Trade Policy Programme is multifaceted and aims to reduce barriers to trade, increase business competitiveness and enhance the trade regulatory environment in the East African Community (EAC). Aside from reduction of NTBs, TMA also continues to support efforts towards enhancement of the operational efficiency and capacity of selected One Stop Border Post (OSBPs) along the East African Trade Network and beyond.